"Ryder is well positioned to provide the innovative and impactful customer solutions demanded by the marketplace today.

Supported by a disciplined capital allocation strategy, we are focused on strategic investments that will create long-term growth opportunities for revenue and earnings.

SCOTT PARKER

Executive Vice President & Chief Financial Officer

Scott Parker, Executive Vice President & Chief Financial Officer

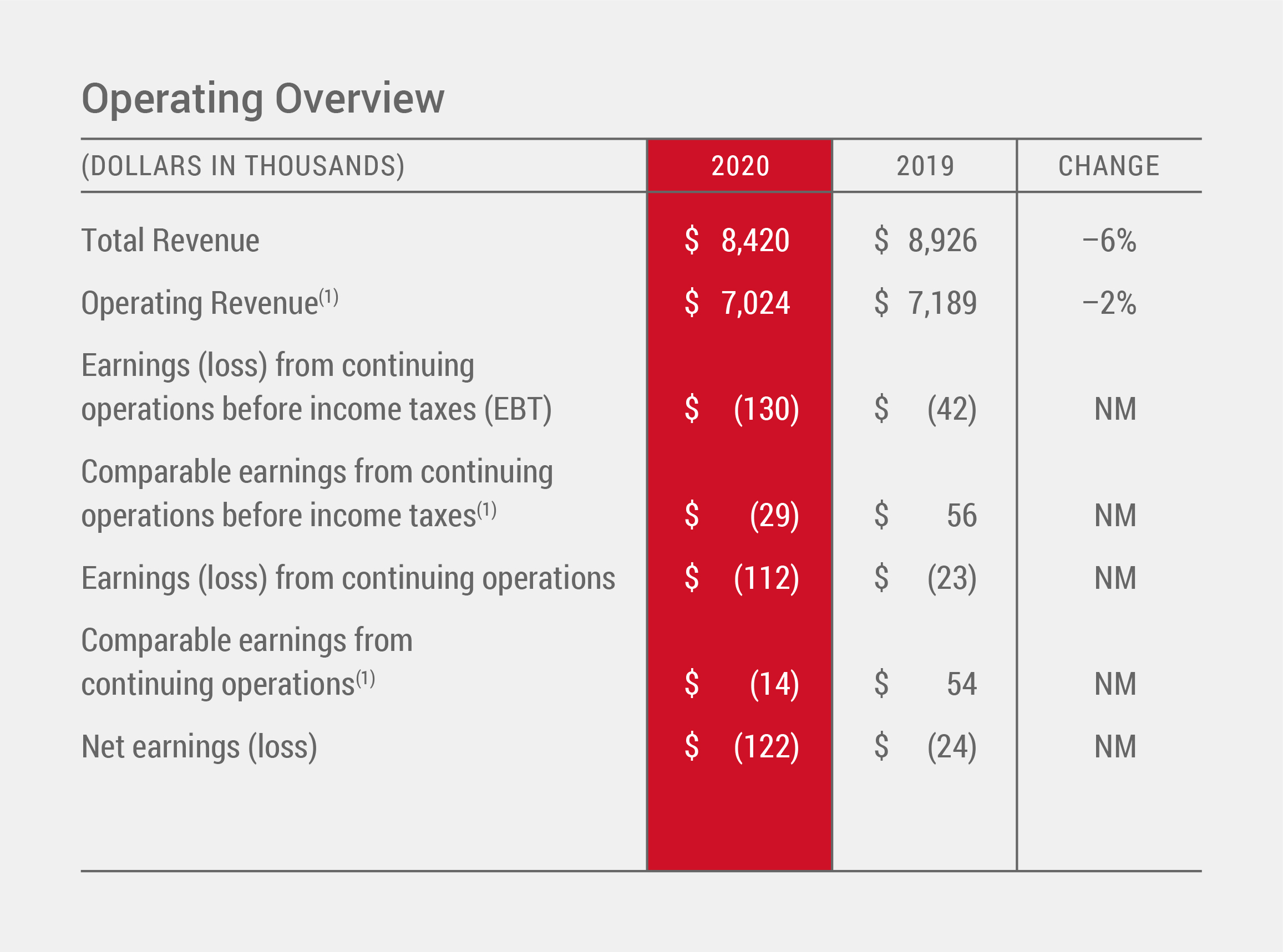

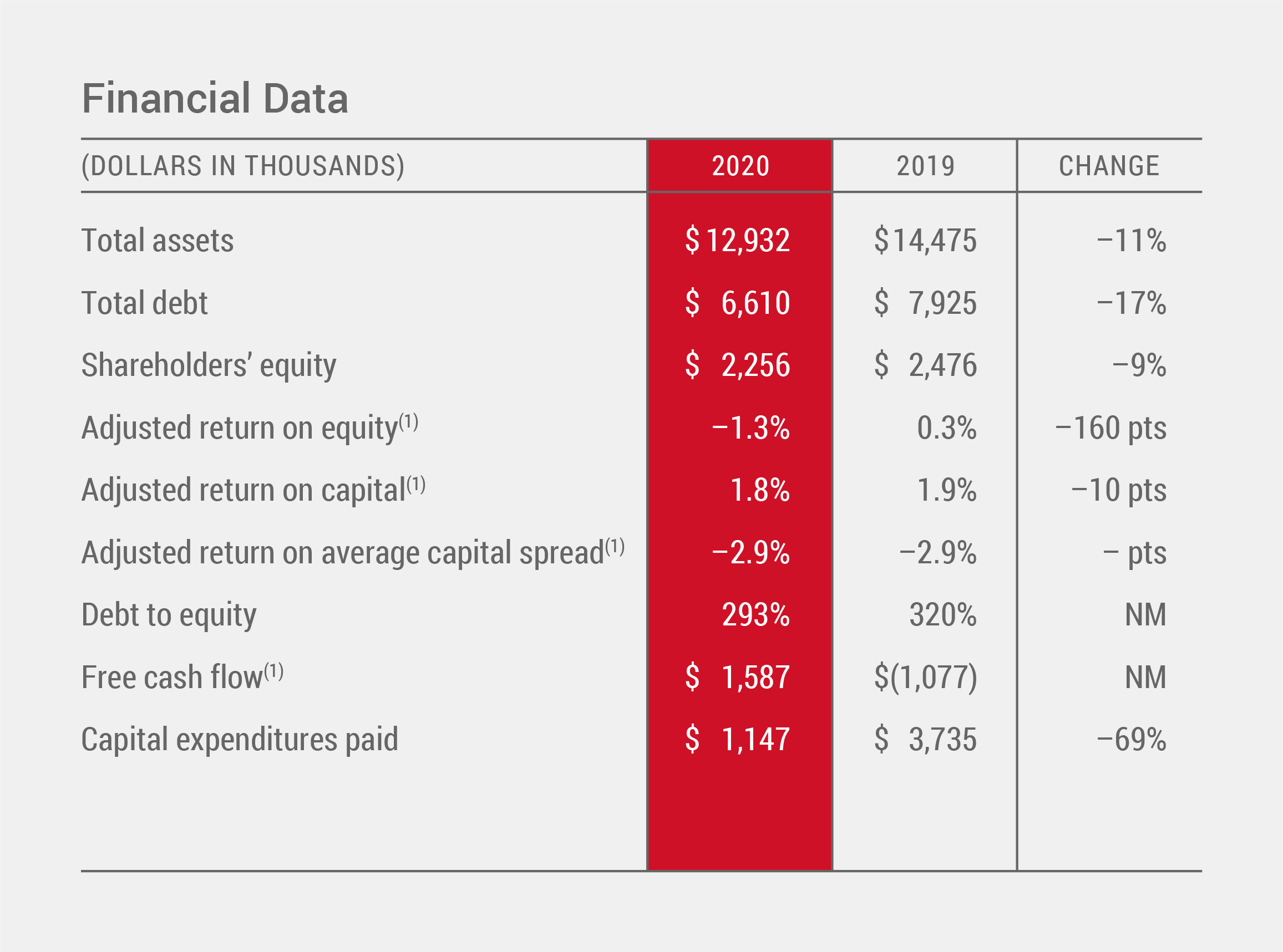

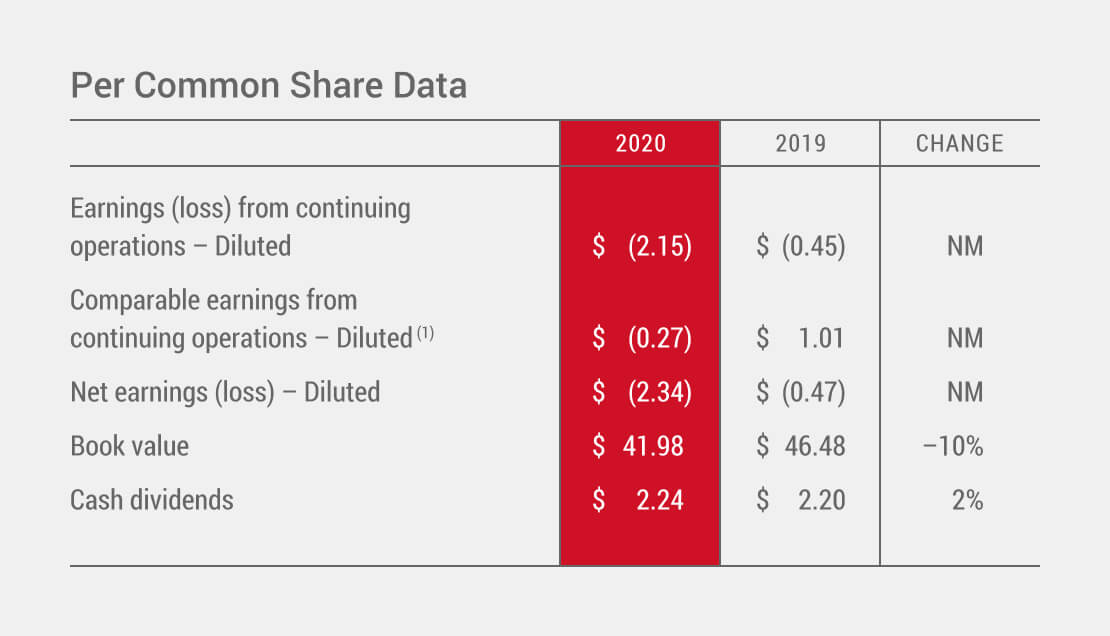

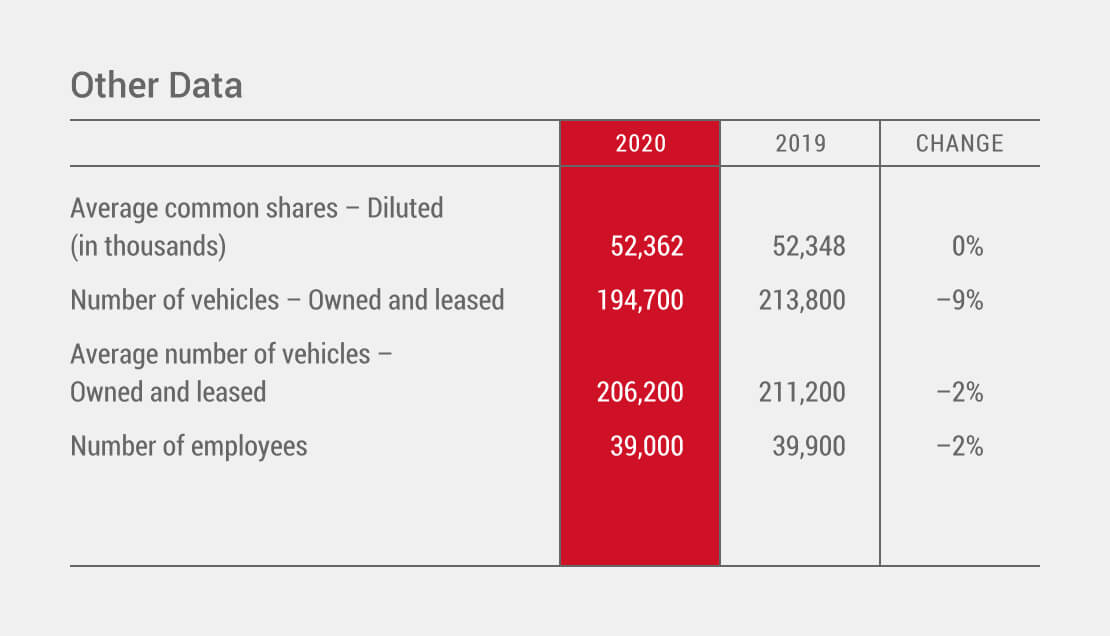

(1) Non-GAAP financial measure: For a reconciliation of these non-GAAP financial measures, click here to access our “Non-GAAP Reconciliation” presentation

NM – Not Meaningful